The Best Way to Pay Off Your House in 10 Years (or Less)

Let’s talk about the best way to buy a house and pay it off fast.

My Standard Definition of a Bubble

Longtime readers are familiar with my background…

I graduated from the Coast Guard Academy in 1996, went to sea for two years, and then settled in the San Francisco Bay Area to work on the Coast Guard Pacific Area staff and go to grad school.

I was at the Academy from 1992–1996, and totally cut off from the outside world, and then at sea from 1996–1998, and totally cut off from the outside world. So, when I rotated back to society in 1998, I wasn’t really up on current events. The last I heard, it was 1991 and we were having a great big recession. What had happened? Everyone was happy all of a sudden.

San Francisco was a pretty magical place back then. First of all, it was a lot cleaner. The Tenderloin has always been a mess, and Market Street has always been a bit gritty, but it was better than it is now. I never spent any time in Silicon Valley proper, but I went to business school at the University of San Francisco up at Lone Mountain, one of the most beautiful neighborhoods I have ever seen.

It had an entrepreneurship track in the MBA program, which I skipped. I was a finance major, and I was going to work on Wall Street.

Everyone else thought that was weird. Why would you go to the University of San Francisco if you are going to work on Wall Street? All my classmates were going to work in technology in some capacity.

So, my first-ever class at USF was financial accounting, and I remember the professor saying something about “venture capital.” I followed her into the elevator and asked…

“What’s venture capital?”

I was about as unsophisticated as you could possibly get. And I was plopped in the middle of the one of the greatest stock market bubbles in recorded history. It took me a while to realize that was unusual.

I drove in and out of the city every day, and what I started to notice was that all the billboards were for internet companies. I remember a big one for WebEx right before I went over the Bay Bridge. I remember going to the Oakland Coliseum to see the A’s and seeing advertisements for Yahoo! and such.

This was before the time I spent on the P. Coast, where my firm once took me to dinner at a seafood place downtown called Blue. It was opulent beyond description. I had all the free food I could eat, so at least I was getting something tangible out of this bull market.

What I knew was that people were making money all out of proportion to their intelligence and work ethic, which has become my standard definition of a bubble.

There were some dumb people on that trading floor making very good money. Some of them were making ridiculous money. They were lucky enough to be in the right place at the right time, which they didn’t really realize.

One day, the San Francisco Chronicle sent some reporters down to the trading floor. They interviewed one of the traders, who said: “I can’t believe how much money I’m making!”

-

It wasn’t long before…

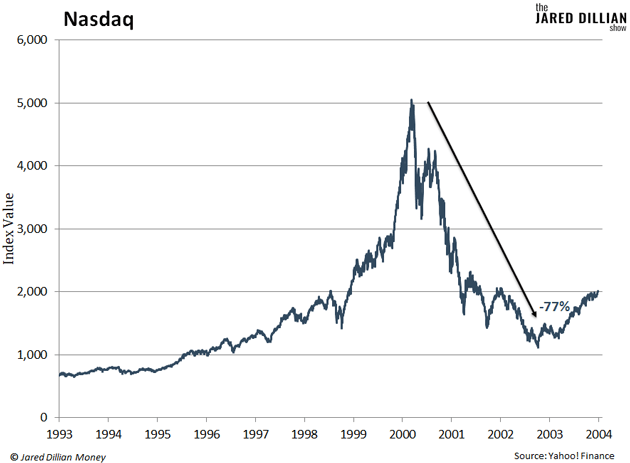

The tech-heavy Nasdaq crashed 77%.

Nothing lasts forever.

Risk Management

I bring this up because, in the past year, people who have no business keeping money anywhere but a bank account are speculating on cryptocurrencies, or meme stocks, or NFTs, or other things they really don’t understand. They’re downloading free trading apps and screwing around.

The problem here isn’t that people are making money. The problem is the risks they are taking to do it. Remember, our first goal here at Jared Dillian Money is to help you eliminate financial stress. And one of the main sources of financial stress is risk.

So, instead of putting energy into some speculative craze, now is a good time to assess your financial risk.

-

Emergency Fund. Everyone needs an emergency fund with at least $10,000 in cash or enough to cover six months’ worth of living expenses—whichever is greater. This is more important than investing. And it is more important than paying down debt. If you haven’t set up your emergency fund yet, you have too much financial risk.

-

Stock Overload. If 100% of your investment portfolio is in stocks, you have too much financial risk. Even 80% is too much. In fact, I encourage people to keep just 20% of their investment portfolio in stocks. The rest should be in bonds, cash, gold, and real estate. You can learn more about that here.

-

Debt. No surprise—debt carries risk. Even if your only debt is the mortgage on your house, how are you going to make those payments if you lose your job? If you want to reduce your risk level to the absolute minimum, eliminate all of your debt. If you want help with that, it’s available here.

-

Gold. Everyone should own some gold. It holds its value over time, and it tends to do well during market crashes. It also makes your overall portfolio less volatile. If you do not own any gold, you have too much risk.

I do not know anyone who’s gotten rich screwing around on a trading app, at least not on a permanent basis. But I know plenty of people who have taken on too much risk and regretted it.

Jared Dillian

|

When Half a Million Dollars Isn’t Enough… Do This

New York City is full of people who make half a million dollars a year. And yet, many of them have a low quality of life.

Don’t freak out. Stick to the Plan.

When you become a millionaire, nothing really changes. One day you are not a millionaire and the next day you are. But you are still you. Your life is the same, with the same worries and concerns.

Really, You Only Need to Do This Once a Year

A few years back, there was a rumor circulating about Fidelity’s top-performing investment accounts. As the story went, they either belonged to dead people, or to people who had simply forgotten about their accounts.

‹ First < 25 26 27 28 29 > Last ›